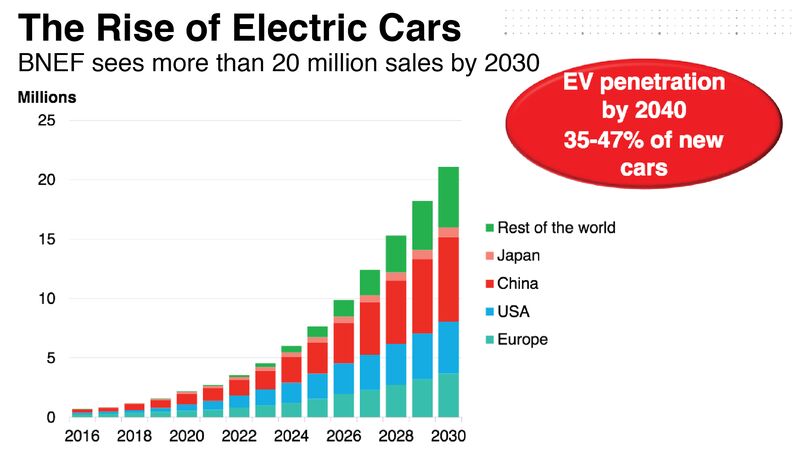

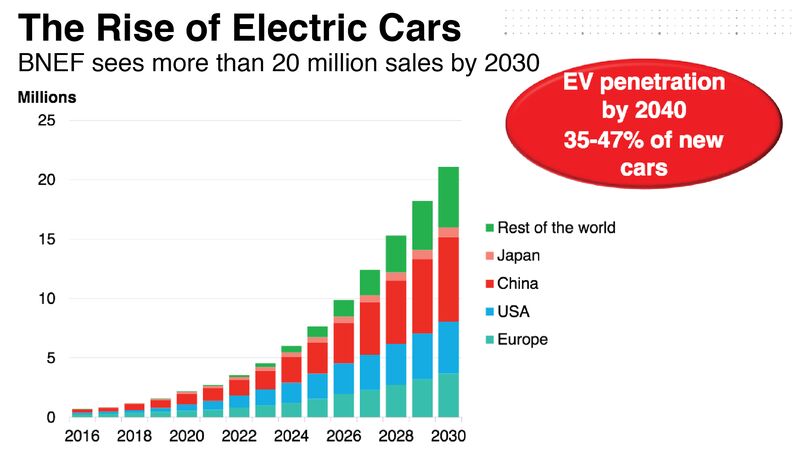

As reported by Bloomberg: Electric cars are coming fast -- and that’s not just the opinion of carmakers anymore. Total SA, one of the world’s biggest oil producers, is now saying EVs may constitute almost a third of new-car sales by the end of the next decade.

The surge in battery powered vehicles will cause demand for oil-based fuels to peak in the 2030s, Total Chief Energy Economist Joel Couse said at Bloomberg New Energy Finance’s conference in New York on Tuesday. EVs will make up 15 percent to 30 percent of new vehicles by 2030, after which fuel “demand will flatten out,” Couse said. “Maybe even decline.”

Couse’s projection for electric cars is the highest yet by a major oil company and exceeds BNEF’s own forecast, said Colin McKerracher, head of advanced transport analysis at Bloomberg New Energy Finance.

“That’s big,” McKerracher said. “That’s by far the most aggressive we’ve seen by any of the majors."

Source: Bloomberg New Energy Finance

Other oil companies have been trimming their long-term forecasts for oil demand. Royal Dutch Shell Plc Chief Executive Officer Ben van Beurden said in March that oil demand may peak in the late 2020s. It set up a business unit to identify the clean technologies where it could be most profitable.

Electric cars are beginning to compete with gasoline models on both price and performance. The most expensive part of an electric car is the battery, which can make up half the total cost, according to BNEF. The first electric cars to be competitive on price have been in the luxury class, led by Tesla Inc.’s Model S, which is now the best-selling large luxury car in the U.S.

But battery prices are dropping by about 20 percent a year, and automakers have been spending billions to electrify their fleets. Volkswagen AG is targeting 25 percent of its sales to be electric by 2025. Toyota Motor Corp. plans to phase out fossil fuels altogether by 2050.

Electric cars currently make up about 1 percent of global vehicle sales, but traditional carmakers are preparing for transformation. In 2018, Volkswagen plows into electrification with an Audi SUV and the first high-speed U.S. charging network to rival Tesla’s Superchargers. Tata Motors Ltd.’s Jaguar and Volvo Cars both have promising cars on the way too, and by 2020, the avalanche really begins, with Mercedes-Benz, VW, General Motors Co. and others releasing dozens of new models.

“By 2020 there will be over 120 different models of EV across the spectrum,” said Michael Liebreich, founder of Bloomberg New Energy Finance. “These are great cars. They will make the internal combustion equivalent look old fashioned.”